What You Missed And What's Coming... In the Week Ahead

The election is in our rearview mirror faster than we expected. The House is still up in the air. But what matters now is how the market will take the Fed's recent policy decision as earnings continue

Editor’s Note: Hello, new readers at the Republic. We’re hard at work on new research opportunities and ideas. Please remember we’ve transitioned Postcards to Finpub.com. Please sign up there to receive emails to your box every day.

Dear Fellow Expat:

She wanted to go to the Maryland Irish Festival yesterday.

But her stomach hurt. When my daughter’s around me when she’s sick, she rests on the couch. She watched the Indiana University football game (I’m an alum) for three hours with almost no comment.

When my wife returned home, she was flailing on the floor. I wanted to nominate her for an Emmy Award: Best Performance of a Stomach Ache. I think my daughter thinks I’m the disciplinarian. I used to feel the same way as my father back in the day.

I came to find out - it was my mother the whole time.

Amelia and I had planned to go to the festival yesterday, so today is our last chance.

Face paintings and Irish dancers.

Let’s get to the week ahead and revisit our columns from this week if you missed any.

Monday, November 11, 2024

Event: Bond Market Holiday & Rivian IPO Anniversary

Why It Matters to You: The Fed CUT rates last week, and the 10-year bond is still at 4.3%. We have to be very watchful right now. We won’t get any answers on fiscal expectations from the Trump administration until Tuesday.

Meanwhile, we reflect on one of the most overhyped IPOs in recent memory.

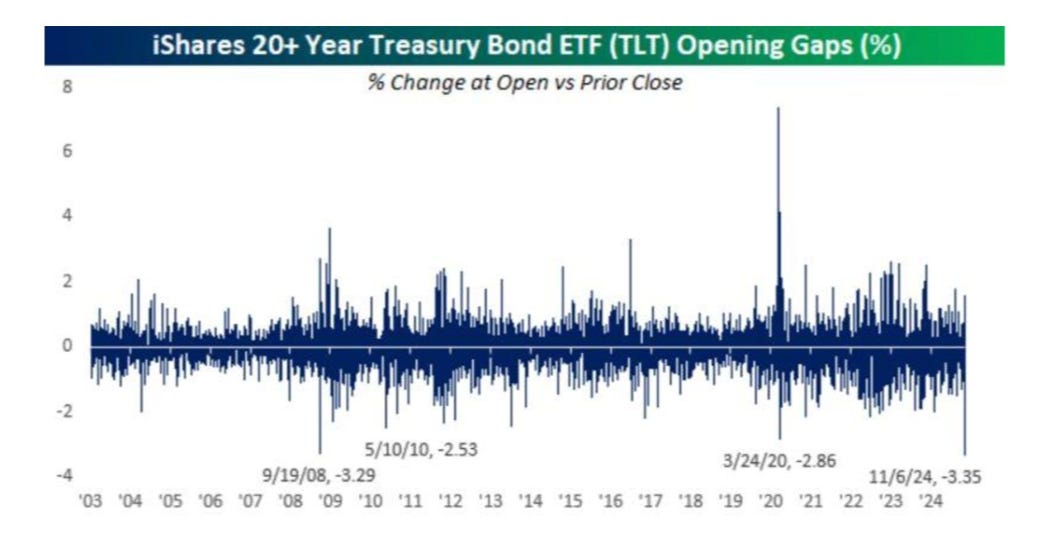

Republic Speak: Long-duration bonds will remain under stress. We just witnessed the largest gap down on the most important long-term Bond ETF on record.

Bonds with more than 10 years' duration will likely see much higher yields as bond vigilantes demand more yield to justify the higher inflation and the prospect of borrowing to afford the interest payments.

Since we’re not getting any information on Monday…

Let’s pour a drink for Rivian (RIVN) and the third year since its IPO.

There was a time when this company was worth more than Volkswagen. Back when money was free, anyone with a PowerPoint presentation could create an electric vehicle company based on the promise of green energy. Shares are now down 91% since that IPO in November 2021, right near the peak of the last liquidity cycle.

They’re just trying to get through the next liquidity market bottom. It worked for Carvana (CVNA). I doubt they’ll be able to survive this round.

Tuesday, November 12, 2024

Event: Home Depot Earnings (HD) & OPEC Monthly Report

Why it matters: The housing market's canary in the coal mine reports earnings while OPEC tells us why we should pay more or less for gas.

Republic Speak: Home Depot earnings day – when we find out if Americans are still willing to spend $500 on a fancy grill while their mortgage rate is north of 6%. With this story, recall that every "challenging environment" or "headwind" mentioned is code for "nobody's buying houses anymore."

If you’re trading HD, look to suppliers like Masco, Scotts Miracle-Gro, and American Woodmark. When Home Depot sneezes, these guys catch pneumonia.

Meanwhile, OPEC's monthly report drops. Expect the usual mix of "robust demand outlook" (we want higher prices) and "market stability concerns" (we want higher prices). They'll probably throw in some comments about "geopolitical tensions." However, weakness in China will likely keep oil suppressed for some time.

Wednesday, November 13, 2024

Event: CNBC Delivering Alpha Summit & CPI Report

Why it matters: Wall Street's wealthiest investors gather while inflation numbers keep the Fed up at night.

Republic Speak: The Delivering Alpha summit is an odd event. We’ll listen to Wall Street billionaires tell millionaire CNBC anchors how to make money—even though most audience members don’t have the access or capital to do what they’re discussing. My predictions: Manager David Einhorn will tell us why something is fraudulent. Then, activist Nelson Peltz will tell us that some companies need more cost-cutting. Then, attendees will nod while checking their phones.

The real show arrives at 8:30 AM. We’ll get the latest Consumer Price Index (CPI) arrives. Investors expect another uptick on a month-by-month basis. That "2% target" is starting to look more like a suggestion than a goal.

As I recently noted, the Fed is probably fine just letting core services inflation rise.

Thursday, November 14, 2024

Event: 13F Filing Deadline & PPI Report

Why it matters: We get to see what hedge funds were buying three months ago and another inflation report to ruin Powell's day.

Republic Speak: With 13Fs and other reports, hedge funds tell us what they bought… checks notes… 45 days ago.

This is like reading last week’s newspaper for yesterday’s weather.

Watch as financial media breathlessly reports what Buffett bought in August. Nothing says "actionable intelligence" quite like three-month-old trading data.

As for the PPI report, it's like CPI's less famous cousin.

Everyone is interested, but we're killing time until the next Fed meeting.

Friday, November 15, 2024

Event: Alibaba Earnings

Why it matters: Time to check if China's Amazon is surviving the nation’s economic problems.

Republic Speak: Alibaba was going to be the next big thing? Remember those years?

Well, now we’re watching analysts try to pretend that Chinese tech stocks aren't radioactive.

Predictions for their conference call and any chatter around financial reports.

"Strong domestic consumption" means “please ignore the property crisis.”

"Cloud growth initiatives" means “we're copying Amazon.”

"Regulatory compliance" means “Beijing hasn't shut us down... yet.”

Then, wait until John and Jane at Goldman Sachs try to reconcile the earnings report with China's official GDP figures.

In Case You Missed It

Buy The Best Ahi Tuna Taco in Town... (11/8)

What’s the best stock you can own that specializes in ONE core thing? It depends on what monopoly you’d want to own… all while understanding how an economic moat can bring you incredible gains in the future.

The Job’s Not Done on Inflation (11/7)

A complete sweep for the Republicans? What does that mean?

Ha. Well… This Is an Easy Call (GEO Up 23%) 11/6

Our No. 1 pick for the Trump Presidency has jumped nearly 100% in six weeks. What’s next? Let’s explore it.

How To Play the Great Spice War of 2024 (11/5)

There’s one stock you want to own as people debate silly things and brands.

The No. 1 Market Rule in the Republic... (11/4)

I stress that you never want to be the person without a chair when the music stops. I will give you multiple ways to avoid a nasty sell-off.

Stay positive,

Garrett Baldwin

GEO was up 43% (not 23%) on 11/6 and 75.5% for the week. I originally bought GEO in early 2023 based on a couple of investors services/sites that I, either pay for or read with regularity. One was Burry and the other was Alpha (unfortunately, I've lost him, as he got absorbed into something bigger). Both said "BUY". So I did and GEO proceeded to go down 30% to 40%. I was sorely tempted to sell, but both of these investment gurus, said "Invest more in GEO", which I heard as double-down. Since then, it's been a rocket ship. It bottomed at 6.95. When it got back to the original value, I added significantly. The rest is history, as GEO has reached my TOP 5 all-time investments. I'm thinking of adding to my position.