DeepSeek: Is This The AI World's "Sputnik Moment?"

A serious subject on an ugly morning for the stock market.

Market Outlook

Futures Sharply Lower: S&P -211bps, Nasdaq -373bps, Russell -100bps

10-year Treasury Yield slides 11bps to 4.52% amid tech selloff and safe haven flows

NVIDIA (NVDA) leads selloff on reports that China's DeepSeek builds rival AI model for $5.6M using a fraction of the chips

Trump slaps then drops Colombia tariffs within hours after the migrant deal; markets eye similar tactics with Mexico

Trump halts federal renewable energy permits for 60 days; Interior Department blocks new solar, wind development on public lands

Good morning:

I want to stress the severity of this weekend’s news about a Chinese AI startup, DeepSeek.

We’re opening Republic Risk to all Postcards readers to help you understand what’s happening in the markets.

We rarely witness these events - and we’re still sorting through them. The violent outflows for the Nasdaq 100 are pressing capital quickly into U.S. bonds.

This could have a rather dramatic impact on the S&P 500 today.

We focus on three essential anomalies at Republic Risk to drive our decisions.

As volatility picks up, we will watch capital flows all day today.

We’ll cover those three elements in a moment…

But first…

AI’s Sputnik Moment?

Global tech markets are taking it on the chin this morning.

It comes down to one reason: the Chinese AI startup DeepSeek.

The AI startup's breakthrough tech is said to beat U.S. AI platforms in cost and efficiency.

This rattled Silicon Valley and sparked a massive sell-off in AI stocks.

The company's rise has raised questions about future spending by U.S. tech giants and AI.

Is this a Black Swan?

This morning, I received an important question: Is this a Black Swan?

It’s more like a Sputnik moment.

A "Sputnik moment" is a wake-up call about a sovereign rival's technology.

Think back to the shock in the US after the Soviet Union launched Sputnik 1 into space in 1957. It sparked over a decade of Space Race, ultimately putting an American on the moon.

If DeepSeek's efficient AI models were built at a fraction of the costs of U.S. firms, this would be "AI's Sputnik moment."

This moment challenges the belief in U.S. tech dominance and suggests that China may have surpassed the U.S. in some areas of AI.

The market reaction has been severe.

Nvidia, the industry leader, plunged 13.60% in premarket trading.

European semiconductor giants ASML and ASM International fell 10.32% and 14.32%, respectively.

The selloff reflects worries about U.S. tech firms' huge infrastructure spending.

Meta and Microsoft each committed over $65 billion in capex this year.

Some think it might be too much.

How'd We Get Here?

Chinese hedge fund founder Liang Wenfeng started DeepSeek last year.

Last week, it reported doing what many considered "impossible."

At a fraction of the cost, it has reportedly developed AI models that rival or surpass those of OpenAI and Meta.

After its January release, the company's mobile app has topped iPhone download charts worldwide.

What makes DeepSeek so unique?

First, it stood out for its ability to explain its reasoning before giving answers.

Next, you'll hear that it takes an "open-source" approach. Developers can freely inspect, alter, or build upon DeepSeek's AI models. This is much different from what's happening in the U.S., where systems from OpenAI and Meta are proprietary.

Open Source speeds up innovation and cuts costs.

It could boost AI by making powerful models widely accessible. It is not a computer virus or anything that allows China to take over other people's computers.

The code's open-source nature means it can be publicly inspected for security issues. Anyone can verify the code, so hiding malicious parts is difficult.

Today’s market fears today center on DeepSeek's claimed efficiency.

The company developed its latest model for just $5.57 million, while Meta's Llama 3.1 reportedly cost $500 million.

This cost gap has investors questioning U.S. AI spending and America’s competitive edge.

DeepSeek's success may undercut U.S. export controls on advanced semiconductors to China. The company's progress suggests that Chinese engineers have optimized AI development with fewer resources.

This would undermine a key pillar of U.S. tech supremacy.

Is This a Contrarian Buying Opportunity?

It's important to not think like the herd in this environment and consider the situation.

Of all the views I've seen over the weekend, I prefer Cantor Fitzgerald's the most.

The investment firm thinks this may signal a market overreaction.

In a research note, they argue that DeepSeek's breakthrough is actually "very bullish with AGI seemingly closer to reality." (More on AGI in a moment.)

To explain why they’re bullish, the investment firm cites Jevons Paradox, an economic principle.

Learn this term—Jevons Paradox—and write it down because it is very important. The principle states that tech efficiency leads to higher resource use.

It suggests that DeepSeek's work will increase, not reduce, the demand for computing power. (This means that in the future, electricity demand will increase, not decrease.)

Cantor also questioned the truth of DeepSeek's reported costs. They noted reports suggesting the company might use "50k Hopper GPUs vs. stated 10k A100s." This will likely be uncovered in the next few days, which could be bullish for NVIDIA.

This discrepancy also raises questions about transparency, given China's "GPU embargo." The U.S. had taken steps to prevent China from accessing advanced chips.

But like the Russian oil embargo, the previous administration was good at sternly worded warnings but terrible at implementation.

An Overreaction and Buying Opportunity?

Ultimately, DeepSeek's advances bring us closer to Artificial general intelligence (AGI).

AGI systems would be able to learn and perform any human-intellectual task.

This surprise progress will likely boost investment in pre-training, post-training, and real-time inference, which require a lot of computing power and electricity.

DeepSeek's efficiency innovations could make AI more common, increasing the demand for advanced chips and expanding the market for companies like NVIDIA.

Therefore, it could offer retail investors an opportunity to buy Nvidia at a cheaper price.

Efficiency gains might hurt near-term margins, but they should speed up AI adoption.

This will open new opportunities for both seasoned players and fresh innovators in this rapidly changing world.

Today's DeepSeek selloff confuses cost efficiency with national security imperative.

This isn't about chatbot economics—it's about a race for AI supremacy that the U.S. will not concede.

Here’s what to do as a trader and investor.

Actions to Take:

Watch for institutional dip-buying as this reality sets in.

Pre-market's 6 am bounce suggests algorithms are already testing levels. If this proves a more serious threat, expect bull traps to serve as exit liquidity.

However, there are other key things to remember.

Don't Panic Sell

The dramatic market reaction to DeepSeek is more likely overblown than not.

Some worry about efficiency and costs. However, Cantor's analysis says this could boost AI use and raise computing demand. Panic selling into this volatility could mean missing out on a potential recovery.

Consider Buying NVIDIA on Weakness

The drop in NVIDIA stock could be a good buying opportunity. The company leads in AI chips. Analysis suggests that DeepSeek's breakthrough could boost, not reduce, demand for high-end GPUs.

Look for Quality, Discounted Names

The tech selloff is creating opportunities in strong, AI-focused firms. Companies like Microsoft and Meta have invested heavily in AI. If a thesis about rising compute demand is correct, these names may be oversold.

Maintain a Long-Term Perspective

The AI revolution is still in its early stages. DeepSeek's emergence validates that AI technology is advancing faster than expected. Short-term volatility shouldn't override this sector's long-term growth potential.

Practice Position Sizing Given

New positions should be sized appropriately for the volatility. Start with smaller positions and add more if prices drop. Avoid huge one-time investments.

Diversify AI Exposure

Instead of focusing only on semiconductor stocks, spread AI investments across:

Chip designers (NVIDIA, AMD)

Infrastructure providers (Microsoft, Amazon)

AI software companies

Pick-and-shovel plays like data center REITs

Electricity - utility - providers. AI electricity demand will surge in the future.

Above all else, remember:

Market overreactions often create opportunities for patient investors.

DeepSeek's breakthrough is significant. It likely speeds up the AI revolution.

Now… let’s get to the rest of our daily analysis…

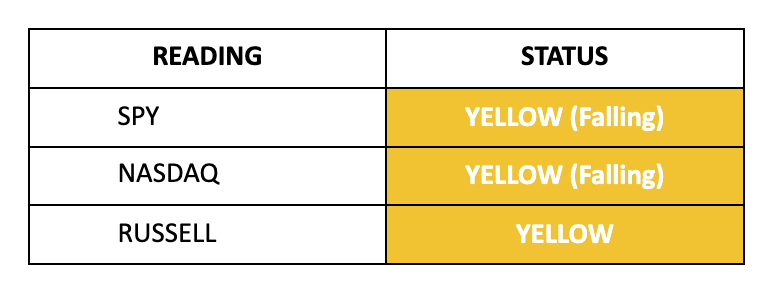

Broad Market Momentum:

Momentum Weakening Fast

Friday's tech selloff accelerated over the weekend following China's DeepSeek breakthrough in AI. What started with semiconductor weakness has broader implications for the Magnificent Seven heading into a crucial earnings week. While momentum remained broadly positive at Friday's close, conditions are weakening across tech, industrials, and energy.

The S&P 500 ETF (SPY) is at its 20-day moving average. The Russell signal has been bouncing around for a few weeks. We’ll see how this market behaves in the first hour - but as I have said, it’s not a reason to panic sell.

Insider Buying

Still Very Few Buyers (Blackout Period)

The ratio of Buys to Sells: 1:186 (4.8M to $914M)

Top Buy: $2.9M of PBF Energy (PBF) by 10% Owner Carlos Slim

Top Sell: $705M of Oracle Corp (ORCL) by CEO Safra Catz

Interesting timing seeing Oracle’s CEO Safra Catz sell stock while Donald Trump announces Oracle’s involvement in the $500B Stargate AI initiative. Executives sell shares for various reasons—perhaps Mrs. Catz has her eye on a new mega yacht—but the timing certainly raises questions.

Liquidity

Markets digest $139B in Treasury supply today across 2yr/5yr notes, with $44B more in 7yr paper tomorrow. The timing looks tricky - Chinese liquidity is cooling while U.S. regional bank reserves show strain. Watch how markets react to this supply ahead of Wednesday's Fed meeting.

Things could get rocky here shortly - and the Federal Reserve may ultimately need to provide support (unexpected by so many people) later this year. In our 2025 Outlook, we discussed how surprise QE is possible later this year.

Stay positive,

Garrett Baldwin

DeepSeek is bull stuff without 3nm technology (ASML EUV Lithography) which we called etching is forbidden to sell to China and other countries. It's a global monopoly. 3nm is about the size of a single strand of human genome!

Mark Andersen, made claims about the Biden administration’s approach to AI control. In December 2024, Andreessen described meetings he had with government officials in May of that year as “absolutely horrifying”. According to Andreessen, the officials suggested that AI would be completely controlled by the government and that AI startups would not be allowed to exist.

Andreessen claimed that the officials stated AI would be limited to “a game of two or three big companies working closely with the government”. He paraphrased the officials as saying they would “wrap them in a government cocoon” and “control them”