A Zombie Stock Market Races Toward the Inevitable

Money is leaving active management and pouring into passive vehicles like ETFs. What will cause it all to come down? You get three guesses, and the first two don't count.

Editor’s Note: In the previous version of this article (including the email) there was an omission of a key transition line to explain the connection between ETFs and liquidity events. It has been added.

Dear Fellow Expat:

One of the biggest problems for bears—the ones who predict a 25% to 50% drop in the equity markets—is the structural change in U.S. equity markets over the last decade.

While the newsletter business was full of calls about Nvidia (NVDA), Palantir (PLTR), and Tesla (TSLA)—which we highlighted in September before the election as oversold—the markets did what they do on repeat.

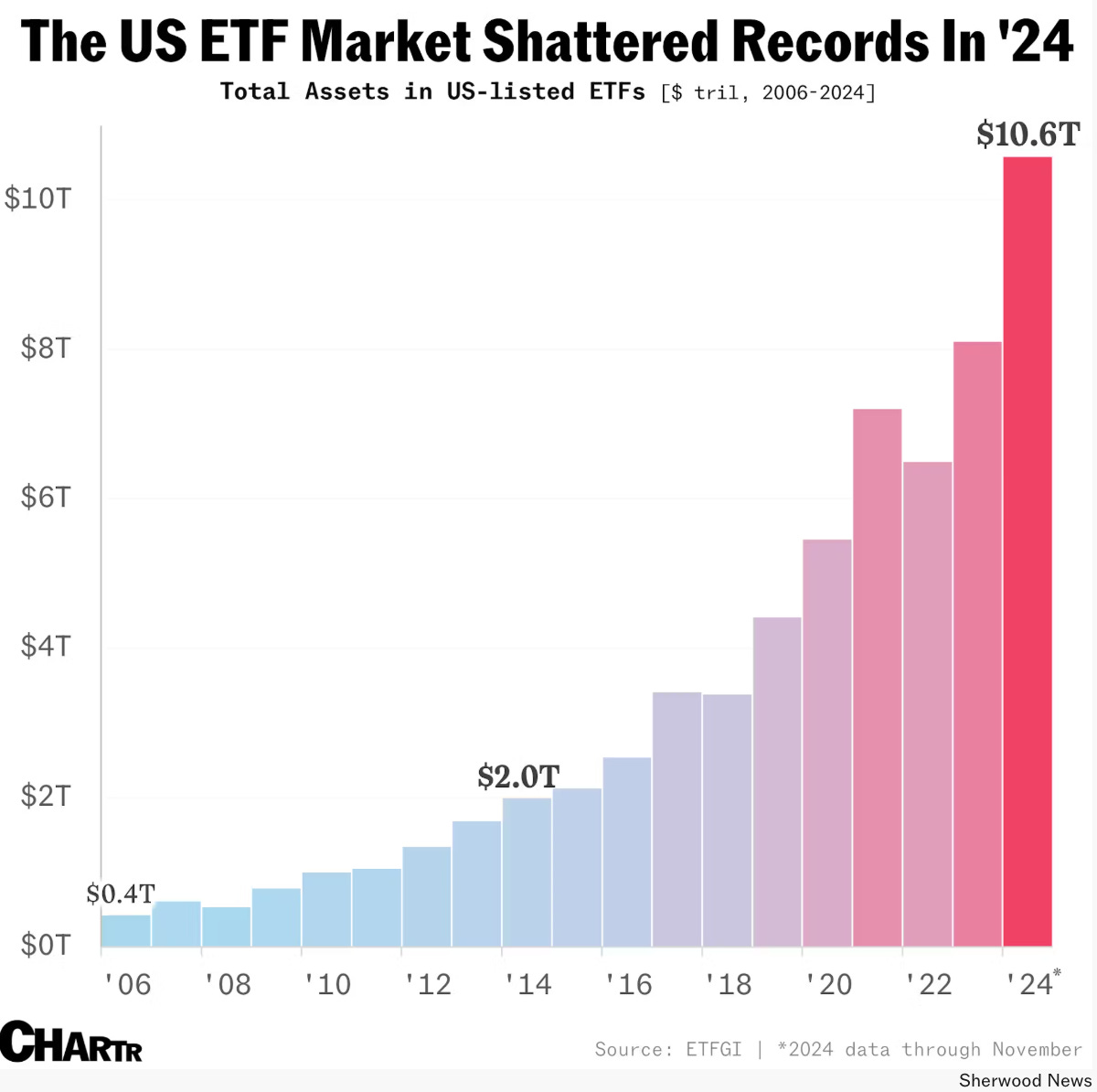

Last year, investors poured another $1 trillion into the Exchange Traded Fund world – bringing the passive investment total in ETFs to a stunning $10.6 trillion. Here’s the chart from ETFGI data via Chartr and Sherwood News.

All the while, investors pulled $450 billion out of actively managed stock funds, outpacing the outflows of $413 billion the year prior, according to EPFR. The markets are on autopilot… at least 80% of it when we combine the passive investment world and the managers trying to replicate their benchmarks.

Lower costs are attracting those outflows. So, too, is performance.

More passive investing isn’t necessarily bad for the market. But it does impact price discovery. The reality is that the stocks in the ETF will only exit those funds one of two ways. First the fund closes. That’s unlikely.

ETF managers like Blackrock and Vanguard are happy to slap that stock into an ETF and then lend it to short sellers to do whatever they want. Those shares will generate a nice 1% to 2% return for the money managers as they give investors what they want:

The ability to set the whole damn thing on autopilot.

The second way is that there is forced-selling.

Forced selling occurs when investors must sell assets due to margin calls, redemptions, or fund rules, often driving prices lower regardless of fundamentals.

Notable periods of forced selling since 2008? It’s all the usual suspects.

2008 Financial Crisis: Margin calls and deleveraging in the housing and credit markets.

2011 European Debt Crisis: Sovereign debt concerns led to widespread liquidations.

2015-2016 Energy Crisis: Oil price collapse triggered forced selling in energy-linked assets.

Late 2018: Fed rate hikes and trade tensions sparked a sharp market downturn.

March 2020 (COVID-19 Crash): Liquidity crunch and panic selling amid global shutdowns.

2022 Bond Market Selloff: Rising rates and inflation caused heavy outflows from fixed-income and equity markets.

It’s All About Liquidity

That returns us to the very important argument to end all arguments: It all comes down to liquidity in the system. If liquidity drains at an extreme level, then watch out. But when you hear someone warn of a crisis - remind them that every crisis IS a liquidity event.

See the - 2008 GFC, the 2011 European crisis, the 2015/16 China crisis, the 2018 bond frenzy, the 2020 COVID crisis, the 2022 GILT crisis, and even the selloff we saw in late 2023 due to rising U.S. bond prices (which impacted borrowing collateral).

This is why AIG stock plunges during these events.

The stock is a proxy for default risk. Be patient - because if we do get a major downturn - toward the end of 2026 and into 2027 - you’re going to get a once-every-five-year opportunity to buy AIG and ride central bank easing into outrageous gains.

Here’s the performance of AIG from 2010 until 2024. You’ll notice a liquidity event that aligns with their lows… but also a central bank pivot that runs the stock higher each time.

In 2011, the ECB’s maneuver and the U.S. debt ceiling shifted to turn the tide.

In 2015/16, the “Shanghai Accord” didn’t happen, according to Janet Yellen.

In 2018, it was the pivot by the Fed to QE4 and rate cuts.

In 2020, it was every central bank printing money like addicts and slashing rates to 0%.

In 2022, the Bank of England pivoted away from the GILT crisis.

In 2023, the Treasury Department's suppression of the 10-year bond largely started after the 5% surge.

This is - sadly - how markets work. It comes down to central bank pivots.

And when China does take action - and they have to because their property markets have imploded - it will be more of the same.

I still find it confusing that Goldman Sachs is putting so much faith into “moderate earnings growth rates” for the year ahead when the last 16 years have reliably shown that the market depends on liquidity, momentum, insider buying (and buybacks), and central banking pivots. As always, they insult our intelligence.

If you haven’t seen our 2025 outlook… be sure to check it out.

Let’s recap the week.

December 30, 2024

Five Stock Market Questions for 2025...

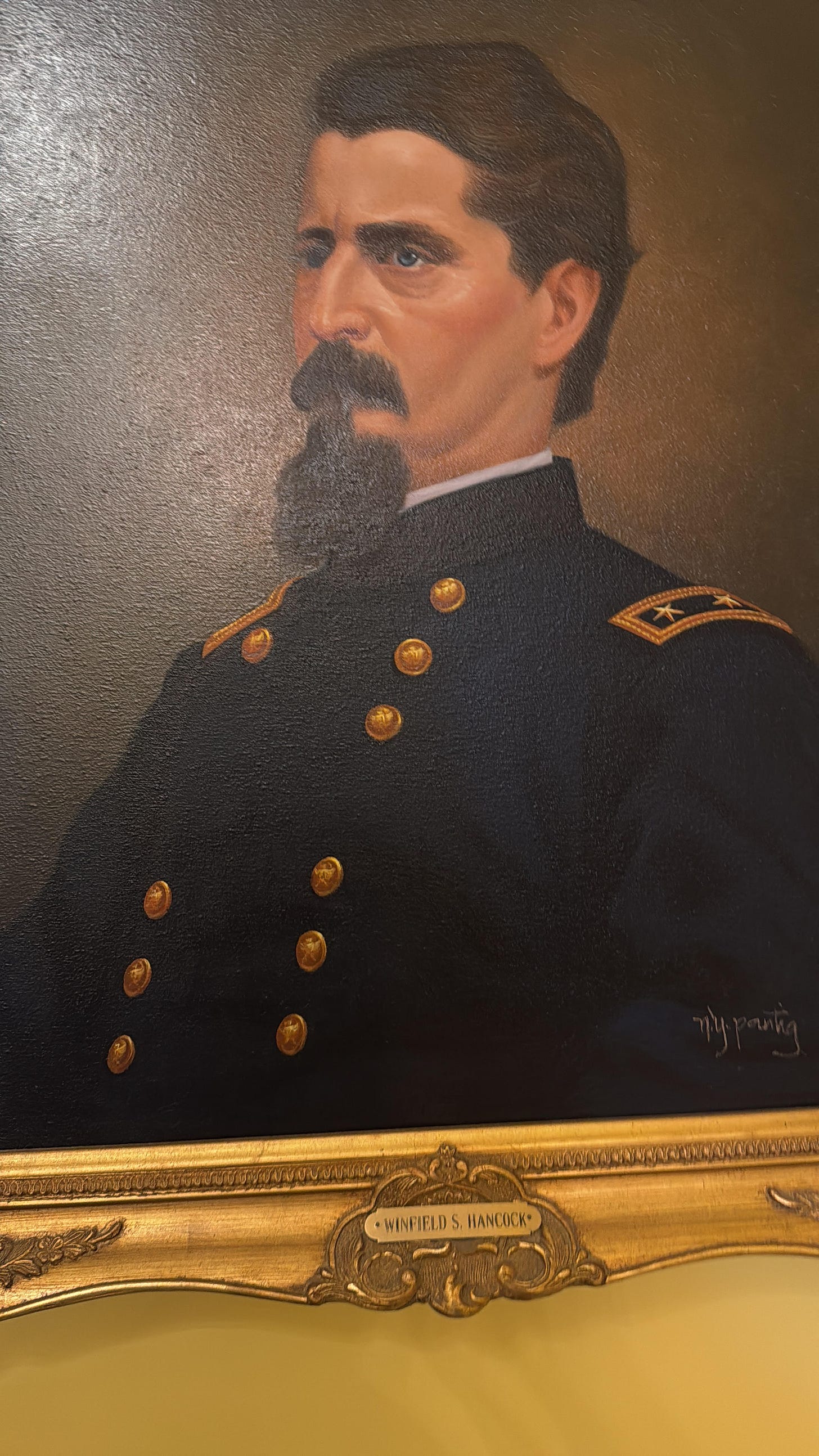

What are the risks for the year ahead? How quickly could the markets turn on President Trump? Are 6% yields possible? And what about that creepy Union General portrait watching me sleep on Sunday night?

All of your questions, my friends, will be answered.

December 31, 2024

My One Digital Hope for Next Year...

If we want to solve our ongoing inflationary and government spending crisis, there's one hope: Transparency. If we are allowed to, we can start small.

January 1, 2025

Has a Swan Emerged? (Plus Quality, Value and Income Plays for 2025)

While Eastern Europe faces challenges in the natural gas procurement world… we have a full list of stocks for the year ahead that stand out for quality and value. Due to China’s economy and U.S. yields, it'll be a rocky year. Hovever, a pivot on central banking policies in both nations should serve these stocks very well.

Let’s fill up the portfolio tank with some ideas.

January 2, 2025

You'd Better Learn The Rules of the Republic

New to the Republic? Need a refresher? We recount the rules for the year ahead, our mission as investors and a community, and why you need to own a sportscoat.

These are the Rules of the Republic.

January 3, 2025

New Year Things I Think I Think

Now that I have a lease with the most notorious private equity company in the local real estate markets, I feel I have the right to rant. As we conclude the first week of the trading year, we discuss China, rent costs, why a fool leads Honduras, and what to make of oil markets.

Oh… and why you must buy some steak today.

We’re off to play miniature golf…

Cheer on Amelia.

She’s gonna need a lot of luck to win the family title.

Stay positive,

Garrett Baldwin

Hello all. I left out a transition in my piece this morning while editing. It has been updated. Apologies if you read the email and part one didn't line up with part two.

Mr. Baldwin

The article in this link has some interesting ideas regarding the future monetary system.

https://themarket.ch/interview/russell-napier-we-are-headed-towards-a-system-of-national-capitalism-ld.12718?_bhlid=d96f704918a9a361e22f24f9ef3db079b6b1afa0

enjoy,

CB