Five Stock Market Questions for 2025...

I have questions... you have questions... let's test them out...

Dear Fellow Expat:

I returned home after an overnight date with my wife.

We stayed in a Civil War-era hotel in northern Maryland. The cottage was filled with pictures of Union military leadership like old Gen. Winfield Hancock here.

Back home, my daughter (still on Holiday Break) has been playing a “game video” based on the film Home Alone. The video runs, and she follows, jumping around. …

Considering that Home Alone is just the holiday version of Saw, I’m concerned.

I have questions…

But why is this a thing on YouTube for children… pales compared to my big questions about 2025’s markets.

Let’s dive in.

Question 1: What Are the Biggest Market Risks in 2025?

Easy question…

China’s Economy: The Dragon is caught in a doom loop similar to 2015/2016, and it’s dealing with the worst deflationary crisis since 1997. That’s hitting commodities, basic materials, and shipping. The latter sector is dirt cheap (keep an eye on it.) The nation needs to restructure its economy, but it’s failed to do so. While fiscal policies aim to address short-term problems, reality hasn’t sunk in yet. Nominally, China likely needs a stimulus on par or greater than what the U.S. did after its Great Financial Crisis. But doing so would crush the Yuan and unwind all the defense the nation has done to prop up its currency. The inevitability points toward coordination between the U.S. and China (likely favoring the U.S.). But in the meantime, this can get a lot worse - and remember - China doesn’t have the political press that America does. Trade and currency wars are here.

U.S. Debt V. Inflation: This probably isn’t getting resolved over the long term, and the problem escalates in real time. America owes $36 Trillion. Even though all these economists with Ph.Ds keep saying that we have a money printer - the problem is that the money printer is driving more inflation (and no one should believe that inflation is running at just 3.5% when the Chapwood Index points to much higher levels. Believe your eyes.) The long end of the yield curve remains a real problem for the United States as we attempt to address the more than $7 trillion in refinancing required this year at higher rates. If that 10-year rise, it will impact global liquidity, weigh on equity leverage, and spur worries that the Fed will need to raise interest rates again next year.

Trade War: This is self-explanatory, with Trump threatening 100% tariffs.

Disillusionment: A serious issue remains in the U.S. economy - especially among younger Americans. Demographic trends continue to trend downward (birthrates falling, lifespans dropping) while there are growing challenges for people to achieve what they perceive to be the American Dream. Continuing a post-COVID malaise with surging home prices and increasing costs on the things that matter (driven by bad Fed policy for three decades) could hit a breaking point. It’s no coincidence that default rates on credit cards are rising. How does that impact the fiscal health of a nation? Call it Gotham-ization, to cite Batman films.

Valuation Compression: We continue to argue that price-to-earnings and price-to-sales don’t matter so much in a post-GFC world. We say that liquidity levels continue to be the driver of markets, citing the works of Solomon Brothers, Stanley Druckenmiller, and Michael Howell. It’s hard to believe that algorithms are worried about price levels, as momentum is critical in High-Frequency Trading. But that doesn’t mean that the rest of the markets believe this. And - what the market thinks - is what matters. So, the argument goes that valuations are at nosebleed levels - and thus, any liquidity event is some turning point in a broader market reevaluation of stock price multiples. While this did happen in the Dot-Com Bubble… the never-ending central bank activities of the last 15 years have altered perceptions of how money flows. Maybe it all hits a wall - and we return to reality. But I have a hard time believing it happens all at once.

Question 2: When Will China Capitulate Via Stimulus?

This is the most important question of 2025.

To address its underlying debt-deflation problems, China might need to invest more than $2 trillion to $3 trillion.

China’s problems are structural.

However, the Chinese government continues interfering in the economy to favor state-owned businesses while failing to provide a healthy alternative to property investment, spurring so much growth (remember the ghost cities?).

China has defended its currency for a while but has drained capital from its money markets. When all that capital drains, the real fun begins.

The stimulus will likely do what needs to be done: A drop in the Yuan against the U.S. dollar or the gold holdings of the BRICS. That will give China a manufacturing advantage (lower costs benefit customers from abroad).

But… stimulus has a catch.

China’s economic stimulus would boost basic materials, commodities, and other things tied to “real economy” assets. Shipping would benefit, as oil and copper would likely see a sizeable uptick.

Stimulus benefits the manufacturing economy in China.

One would hope that a decision comes sooner than later. However, the stimulus would likely drive even more money offshore from China (which they don’t want in their quest to overrun the U.S. economy). My concern is that this doesn’t get implemented in a reasonable manner until the third quarter.

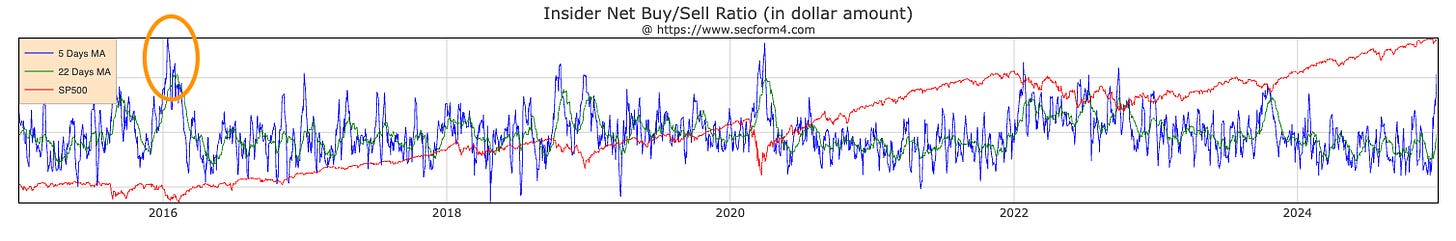

We’ll watch the insiders (CEOs, CFOs, and other 10% owners) on the Dow Jones for clues about when this could happen. The last time we saw significant coordination was in early 2016. The media didn’t pick up on the Shanghai Accord until a few months later.

But it seems that the insiders… marked by this circle on the 5-day moving average of insider buying to selling on an aggregate dollar ratio… shows they knew something big happened that benefited global trade and represented a pivot among central banks.

Stay close.

Question 3: How Fast Could Investors Turn on Trump 2.0?

There’s a real chance that investors will quickly become disillusioned by Trump’s policies and rhetoric.

That starts with tariffs. As I’ve noted, too many people see what they want to see in Trump. “He tells it like it is,” they’ll say. (Does he?)

Or… “He’s just bluffing on tariffs. Don’t you know, he’s a great negotiator!” (He is?)

Trump has said he’s going to hit China with tariffs. His son hired a trade advisor based on an Amazon book search on Chinese Trade (Peter Navarro).

So, believe the man. As always, I have no skin in the game. I’m trying to navigate whatever waters are surging toward me. I don’t worry about politics.

The issue is that we’ll learn quickly what tariffs do to consumers and how that drag can impact investment. There may be pressure to move domestic production back home (which is inflationary), but doing these things takes a lot of time.

Trump has already backtracked on bringing down food prices (which was never realistic without profound supply-side policy shifts).

He said he can’t guarantee that tariffs won’t impact consumer prices (they will).

Technically, the administration could hike tariffs on China and subsidize an industry they chose. However, that policy would be challenged in the World Trade Organization court.

That’s all happening while China builds up its military presence at historic levels.

Then there’s “no taxes on tips or Social Security.” There’s the promise among the GOP to hike the child tax credit of $5,000. And they want lower taxes for high earners.

The CBO estimates that those total costs will add $7.75 trillion to the national debt through 2035. At some point, we’ll have to start talking about real money.

At this very moment, sentiment appears more negative than it did two months ago when we experienced post-election euphoria. That hangover is starting to kick in… and the bond market tells us that inflation will likely persist.

Some is his fault. Some are Janet Yellen’s. A lot is on the Biden Administration.

But we all know where the buck stops, especially in this media environment.

It’s all blame and little credit on the horizon.

Question 4: Are 6% Yields Possible on the 10-Year Bond?

A 6% yield projection on the 10-year has emerged from a handful of analysts in the last few weeks. T Rowe Price analyst Arif Husain offered three factors that should push us through 5% in the year ahead and then keep our eyes on that bigger figure.

Those factors are:

An uptick in U.S. government spending, a healthier U.S. economy, and an extension (or even furthering) of tax cuts.

An ongoing decline in international demand for U.S. Treasury bonds.

Increasing uncertainty around tariffs, immigration, and other potentially inflationary factors on Trump 2.0 policies.

All three factors are negative catalysts. However, since Elon Musk is trying to cut government spending, capital gains should offer a better outcome on the deficit come April tax time.

For two years, I had argued that the Fed should have its Funds rate at 6%, which forced us into a recession and drowned inflation. But they didn’t. And now, we could soon face the highest interest rates in 25 years. I don’t think we’ll get to 6%. I think we’ll top out around 5.5%, which is problematic enough for many banks holding low-interest bonds on their balance sheets. The Fed may have to rehash several programs to pump cash into banking reserves if interest rates increase, as in March 2023.

I remind you that any Fed policy that provides capital to the market is stimulatory. It might not be “Quantitative Easing,” but it will aim to deliver QE-style results. QE-like results always benefit U.S. banks and the financial sector because the U.S. is a financialized economy.

Be ready to buy the banks if they’re forced to turn on the taps… This could be the Fed’s “GILT Crisis” moment.

Question 5: Will the Stock Market Crash in 2025?

There’s a reason why I wrote “stock market crash” and “2025” in this question. It’s called Keyword packing… and that’s how people find my articles in search…

That said… I’ve read a handful of market predictions that are flat-out insane. Someone at Seeking Alpha projected that the S&P 500 would hit 3,000 in 2025.

That’s a 50% haircut. Nope. If that were to occur, the sheer amount of Quantitative Easing that would follow would outpace what we witnessed in 2020. And what’s worse, that’s basically predicting Depression level economic activity and a credit freeze that would be worse than 2008.

How are we defining crash? 2008? 2020?

A 20% drop like in 2018?

I’m going to go with No.

At the moment, China remains a serious concern. In addition, the United States faces higher refinancing rates in the year ahead. But if liquidity remains robust - which it should - this market should hold into the top of that cycle.

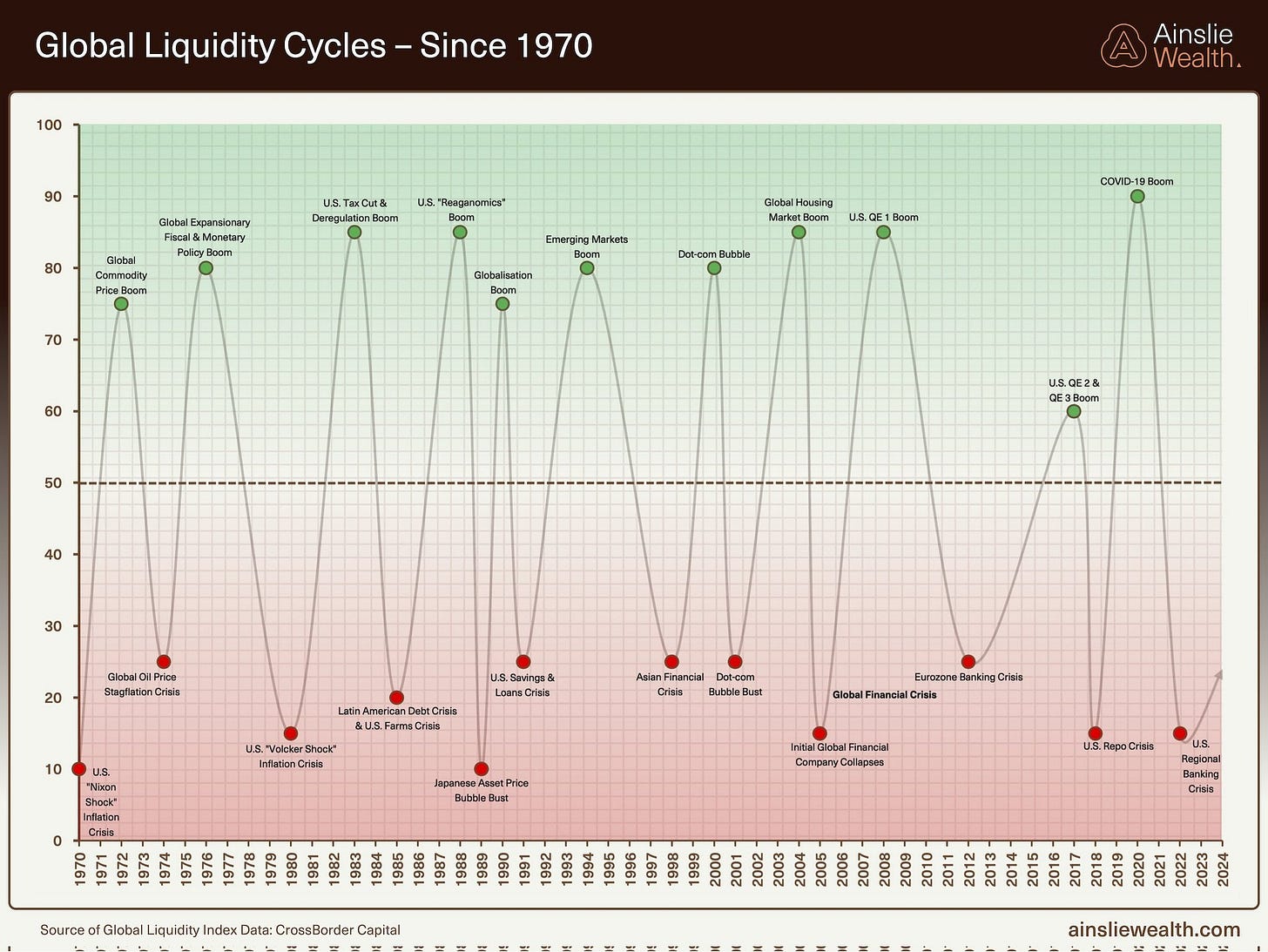

I am far more concerned about what comes in 2027 and 2028. That’s some time away, but that period aligns with the liquidity cycle lows. Pay close attention to this chart from Ainslie Wealth (which tracks the cycles of Cross Border Capital’s analysis.)

While there could be a sharper reaction to China’s economic challenges (similar to what we witnessed in late 2015/early 2016, we should continue to see an uptick in liquidity (even easing) in the year ahead.

Anyway… your mileage may vary.

Stay positive,

Garrett Baldwin

Secretary of Old-Timey Hotels

Garrett: there are five points here, but they are numbered 13445. They’re all great points. Thanks for the article.