Risk: The Mother of All Stimulus Approaches... How to Prepare

If China's about to blow the lid off to prevent a debt-deflation spiral, focus on the one commodity linked to its central banking activity.

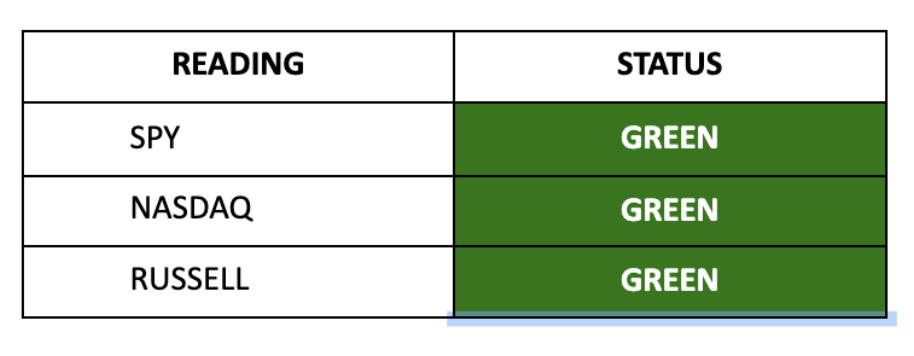

Equity Storm Watch Is GREEN on the S&P 500 and GREEN on the Russell 2000

The good news: Futures are up this morning as investors look to wrap up an extremely volatile August—a month that began with a sharp selloff but has since seen markets rally back.

The Dow is hovering near record highs, while the S&P 500 and Nasdaq are both in the green. They are shaking off earlier losses as optimism builds around the Federal Reserve’s next move.

The bad news: I can't shake the feeling that this market could still blow off some steam. It's hard to believe we've seen a full unwind of offshore capital sloshing around in short-term debt instruments. This creates a significant unknown—how that capital moves from where it is now to where it’s going, which could very well be right back into bills and notes, depending on how the broader economic picture comes into focus. Just watch the signals…

Keep reading with a 7-day free trial

Subscribe to Postcards from the Republic to keep reading this post and get 7 days of free access to the full post archives.