Risk: Listen to Tepper and Howell This Morning...

CNBC keeps trying to sound smart. They need to just let David Tepper talk for four days... and put talk to us all like we're four year old children who need to unlearn all our financial education.

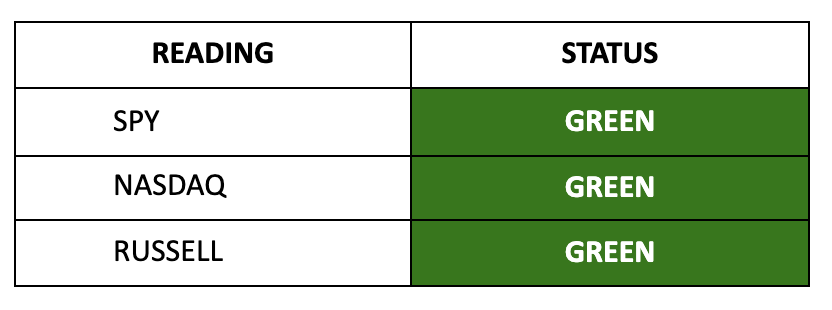

Equity Storm Watch Is GREEN on the S&P 500 and GREEN on the Russell 2000

What a fascinating inflation report. PCE Y/Y came in at 2.7%, with a monthly uptick at 0.1% over August. The mainstream media is claiming that the Fed can declare victory over inflation (um… we all lost badly over the last three years)... you just have to strip out the things that people actually buy like food, energy, and housing. But I digress.

This morning, we’re seeing a sharp reversal in the energy sector, a deflationary element that could impact the Fed’s planned cuts on interest rates. As we forecasted in our Ovintiv (OVV) report during the summer, OPEC is turning against its own and turning on the taps despite lower oil prices.

U.S. producers are able to increase production at lower costs thanks to new technologies that are bullish for the sector. We remain bullish about the midstream, but we anticipate further weakness in the upstream and downstream segments.

Yesterday, we had a lottery play on the XLK in the final hour.

If you took it, you may want to exit the trade near the open. It’s uncertain if the market will squeeze higher into the afternoon - and the euphoria around the PCE could wear off rather quickly.

It’s a Friday heading into a difficult week next week with the jobs report.

Any gains you take now are good, or you can just set a stop back at entry. I’ll be watching this in the first 15 minutes… and hoping that we squeeze up on the XLK to around $229… which should deliver a gain.

This will be a topsy-turvy day.

Dear Fellow Expat:

Two weeks ago, I went full Komodo on my research.

I did so on the 16th anniversary of Lehman Brothers’ collapse.

As I noted, there was just no reason to abandon this market right now. We are now looking at the 10th positive month in 2024 out of 11 months. How is that possible given that interest rates were so high… all while the Fed rolled off its balance sheet?

Does it have anything to do with the fact that the Treasury Department engaged in a massive amount of stimulus over the last year that largely went underreported?

Does it have to do with the massive spike in capital and credit globally that so many investors fundamentally ignore?

I’d say so…

Now, as much as Lehman helped shape my view… I want to point to THIS INTERVIEW…

This came in 2010 – from hedge fund manager David Tepper.

As he noted on September 24, 2010… either the economy would recover – and the market would perform well… or the economy would tank and the central bank would start to pump Quantitative Easing into the system…

And what would do well if the Fed launched new QE?

EVERYTHING. The guy was literally willing to go all in - 100% on equities - and he was one of the first to lay out the fundamental connection between equity performance and the never-ending train of stimulus in the post-GFC world.

Well… guess what?

Tepper delivered a very similar speech again – but this time on China’s stimulus efforts. CNBC this morning keeps asking guests if they share Tepper’s views, and it’s clear that no one really seems to have a mastery of Tepper’s insights.

People are still rambling about personal spending… earnings… saving rates… and all this other garble that can’t even come close to rivaling the impact of pure sugar.

As Tepper noted, China’s central bank offered an unusual statement that suggested significant efforts to propel its economy and markets forward.

I really wish that there was some real alchemy to this market.

I wish there was some sanity that we could all fall back on our MBA, CFA, and CAIA knowledge and think we’re smarter than everyone else.

But the reality is simple.

Liquidity drives markets.

This morning, Michael Howell conducted another interview on his worldview, which helps to shape ours. I highly encourage you to watch it this morning. If you’re trying to comprehend how global capital impacts equities… here it is.

Now… let’s dive into our breakout stock…

Keep reading with a 7-day free trial

Subscribe to Postcards from the Republic to keep reading this post and get 7 days of free access to the full post archives.