Risk: A 50-Basis Point Cut And a Change of Shorts

Everybody calm down. The Treasury is unwinding its backdoor stimulus (worth 100 basis points) while the Fed is cutting rates. This could be a wash.

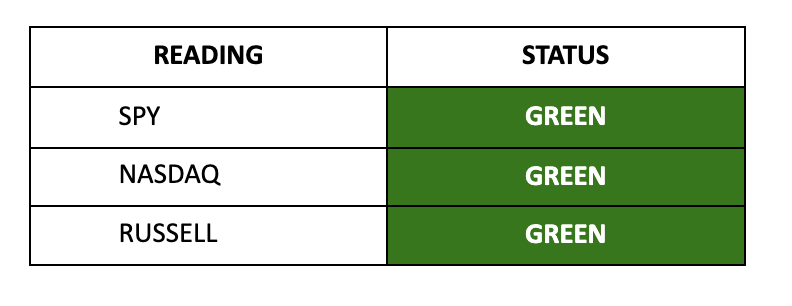

Equity Storm Watch Is GREEN on the S&P 500 and GREEN on the Russell 2000

The Federal Reserve has fired the starting gun on a tricky market to navigate as we wait for the dust to settle on its first rate cut since March 2020. Cutting by a half-point sets the stage for what promises to be a volatile few weeks ahead as the game of markets turns the difficulty knob up a notch or two.

We are Green across the board, and energy is finally moving back into Green territory. It's a good opportunity to sell spreads on the energy front. Insider buying is strong—at levels we haven’t seen since the Nikkei Crisis in early August. Institutions are net buyers. Keep a very close eye on copper. It just keeps ripping higher, a sign that China’s making some effort on its central banking front. I’ll need a copper recommendation—maybe Mueller Industries (MLI).

Dear Fellow Expat:

It’s not ALL good news.

Let’s slow down everyone.

For the first time in 16 years - oddly, just a few days after I released that video on the same anniversary of Lehman Brothers - the Fed slashed interest rates at a 50-point pace.

The jubilee from inside the towers of mainstream media… financial publishing… and anyone mildly connected to finance… is naive.

Calm down. Hold up. Let’s get into the huddle and pull out a clipboard, Jimmy Chitwood.

Let’s start with the obvious.

The Fed’s statement DID NOT justify a 50-basis cut. Read the statement.

Here’s the skinny…

The economy's still chugging along like a stubborn old train. Okay.

Jobs? Eh, we're slowing down a bit. Unemployment's creeping up, but don't panic – it's still "low." Whatever that means.

Inflation is working hard to reach that 2% target. It's "making progress," but let's not break out the champagne. I’ve seen people on Twitter saying it’s slayed. No… a 50-basis cut is inflationary… and China still hasn’t pumped its currency yet. More on that in a minute.

The Fed's got its eyes on the prize: maximum employment and that sexy 2% inflation. They're feeling "confident" now. They were confident about “Transitory Inflation,” too.

Risks? Balanced, they say. The future's as clear as mud; they're watching it like hawks. Or should I say, like nervous squirrels? They're promising to keep their eyes peeled for any economic hiccups. What’s their track record on that again? Zero percent.

They're still playing hot potato with Treasury securities and mortgage-backed whatchamacallits. And they will have to monetize at some point in the future to keep short-term rates lower.

Most of the bigwigs voted for this monetary hocus-pocus. But wait! Drama alert – Michelle Bowman wanted a smaller rate cut. The first rule of Monetary Fight Club: Always listen to the dissenting voice. There’s always truth in his or her justification for going against the herd.

So… why 50 points?

Well, there are a few things that people MUST consider.

First, there has been some coordination between China, Japan, and the U.S. last week. That helped fuel the strongest snapback rally for the Magnificient 7 since March 2023. This could be the start of a pattern for a weaker U.S. dollar.

That’s NOT good news for the consumer.

Second, what is coming down the pipeline? A recession - we’re already borrowing 7% of GDP to print 3% of GDP. That’s insane. That’s a shadow recession. We’re in negative territory on a net basis. A strong economy, though… they say.

Third, and this is the big one. The U.S. has to refinance $9.5 trillion in Treasury obligations over the next 12 months. Don’t you think they see the line item costs of debt? Yeah… they have to cut rates to afford this ongoing explosion in debt servicing.

And here’s where I worry…

Two years ago, the Bank of England threw in the towel on inflation and kept buying securities. So, their security buying would keep supporting the uptick of inflation. It was - in effect - a soft default on their financials.

We’re getting there. I wouldn’t quite put it in Soft Default or Default Lite territory… but we’re just a few years away and always on the verge of accelerating to the extreme on this.

I will be writing about this today at Postcards. Things are NOT GETTING MORE EXPENSIVE IN AMERICA. Your rent, food, housing, and education… are not getting more expensive - that’s a lie out of Washington because they need a scapegoat.

Your paper money is getting weaker. How else do you explain a 60% surge in gold prices in two years? It’s not just central banks. Everyone is deflating their currencies…

They printed one out of every three dollars in existence in the last five years.

And - they’ve been engaged in WILD financial alchemy at the Treasury Department for the last year - with operations providing the same economic impact as about a 100-basis point cut the previous fall, according to Roubini.

So… EVEN if the Fed does cut rates, what happens if the Treasury Department unwinds all of this in the final few months of the year? The net impact would replicate a “rate hike” - if you’re taking all that stimulus away without further Fed cuts.

So, that could explain why the Fed is coming down - while the Treasury Department takes its foot off the gas. In essence, this 50-basis point rate cut may end up having no real impact on the economy - and there will be turbulence even as the central bank continues to lower the rate in 2025. It’s not all blue skies, everyone.

Which brings me back to this last point. And this is what you need to know…

Keep reading with a 7-day free trial

Subscribe to Postcards from the Republic to keep reading this post and get 7 days of free access to the full post archives.