Republic Risk: Turning Point?

This will be an intense week. It's time to hedge.

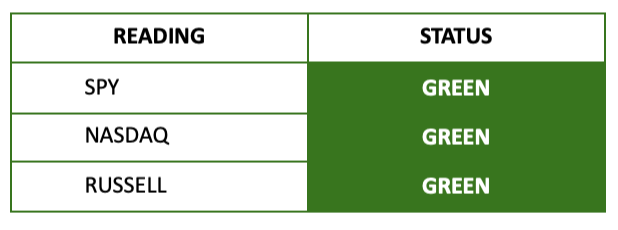

Equity Index Strength Is GREEN on the S&P 500 and GREEN on the Russell 2000

Each morning, we assess the full flows of the market by measuring statistical metrics on a very specific number of stocks to determine broader sentiment and the momentum trend. When these readings turn red, we focus on cash, build trades around positive sectors, or take inverse positions against indices. When it is positive, we focus on short-squeeze stocks, companies with improving fundamentals, and trading/investing around the actions of corporate insiders.

It’s time to sell calls.

It’s time to hedge.

It’s time to protect your money.

We’re seeing the MACD on the S&P 500 and the Nasdaq 100 starting to weaken, retail investors are now back in FOMO mode, and we’re in overbought territory ahead of a brutal week of economic data and monetary policy decisions.

There’s also the prospect of tax harvesting coming. It’s not a crime to take gains.

Keep reading with a 7-day free trial

Subscribe to Postcards from the Republic to keep reading this post and get 7 days of free access to the full post archives.