Republic Risk Letter: Volatility Rises as the 10-Year Screams Higher

The 10-year bond has just hit 4.86%, and oil keeps peeling higher. Tensions are building across the Middle East. The question remains: Where will the funding come from for all of our problems?

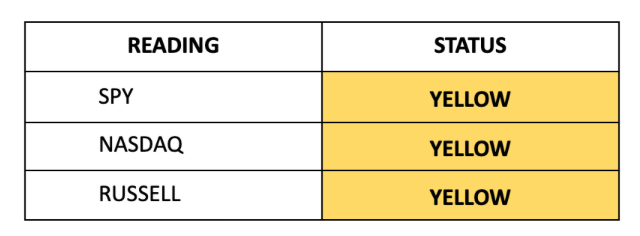

Equity Index Strength Is YELLOW on the S&P 500 and YELLOW on the Russell 2000

Each morning, we assess the full flows of the market by measuring statistical metrics on a very specific number of stocks to determine broader sentiment and the momentum trend. When these readings turn red, we focus on cash, trade positive sectors, or take inverse positions against indices.

We had a positive turn on our signals yesterday to close the trading day, but we’re back in Yellow territory at 10 a.m.

I will be releasing the Republic Risk Letter at 10 am each day to provide better assessments of intraday trading after the morning bell.

The focus right now should remain on the bond market and the energy sector - as a dual set of risks continues to play in the market.

First, the 10-year bond has been pushed to 4.86% this morning, raising questions about the Treasury Department’s ability to refinance an incredible amount of debt on top of next year’s deficit. The market pattern is highly similar to last yea…

Keep reading with a 7-day free trial

Subscribe to Postcards from the Republic to keep reading this post and get 7 days of free access to the full post archives.