Republic Risk: Don't Start Shorting Until the Signal Goes Red

Yes, the FedEx news is bad. But the market is not the economy... and the economy is not the market. The last seven weeks have proven this statement to be true. Plus, an idea for a trade in refineries.

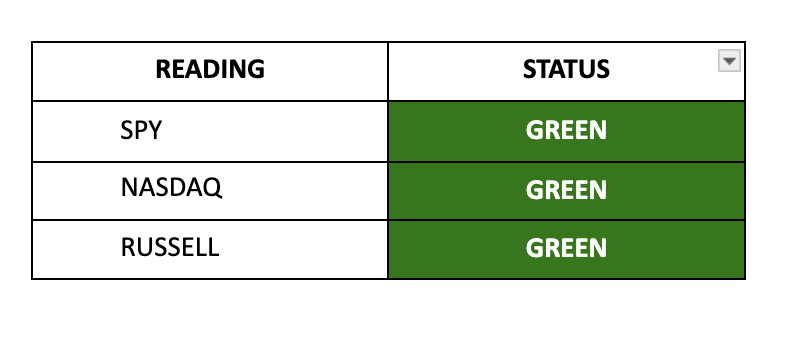

Equity Index Strength Is GREEN on the S&P 500 and GREEN on the Russell 2000

Each morning, we assess the full flows of the market by measuring statistical metrics on a very specific number of stocks to determine broader sentiment and the momentum trend. When these readings turn red, we focus on cash, build trades around positive sectors, or take inverse positions against indices. When it is positive, we focus on short-squeeze stocks, companies with improving fundamentals, and trading/investing around the actions of corporate insiders.

All sectors are still Green.

There will be much focus on the FedEx news, but remember that global liquidity drives equity markets… not one company's performance. So, be cautious if someone tells you to short the market starting today. There’s just too much money sloshing around right now. If we see three days of weakening Signal Strength, it will be time to nail boards to the windows.

We have a few key technical issues at hand. We’re on the verge of hitting…

Keep reading with a 7-day free trial

Subscribe to Postcards from the Republic to keep reading this post and get 7 days of free access to the full post archives.