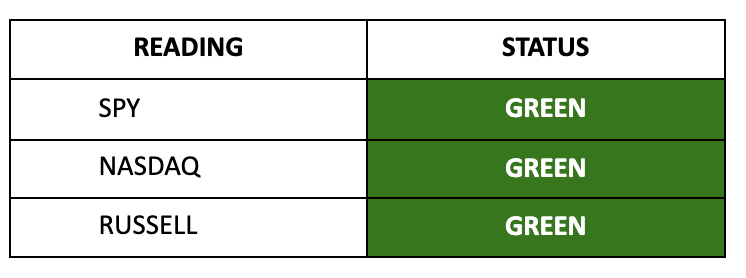

Equity Storm Watch Is GREEN on the S&P 500 and GREEN on the Russell 2000

Dear Fellow Expat:

In one of the clearest examples of how liquidity moves markets, today, we'll try to extend the relief rally to 9 days. After witnessing record amounts of leverage unwind in early August due to the unexpected BOJ hiking rates, US markets continue to attract capital with high interest rates and highly liquid assets.

The S&P 500 and Nasdaq continue their charge, each marking their longest winning streaks of the year as investors load up bets that the Federal Reserve will cut interest rates in September, fueling the market's momentum. Odds are currently at 77% for a 25 bps cut and 23% for 50 bps. All attention is now turning to Federal Reserve Chair Jerome Powell's speech on Friday at the Jackson Hole symposium. The financial community hopes for clear signals about the Fed's next moves. In the meantime, markets are happy to front-run the anticipated change in monetary policy.

--------

Dear Fellow Expat:

Keep reading with a 7-day free trial

Subscribe to Postcards from the Republic to keep reading this post and get 7 days of free access to the full post archives.