Republic Risk: Damage Week at the Fed?

Send out the clowns to try to walk it back... but the genie is already out of the bottle. The Federal Reserve cares more about Wall Street than Main Street... as does everyone else in Washington.

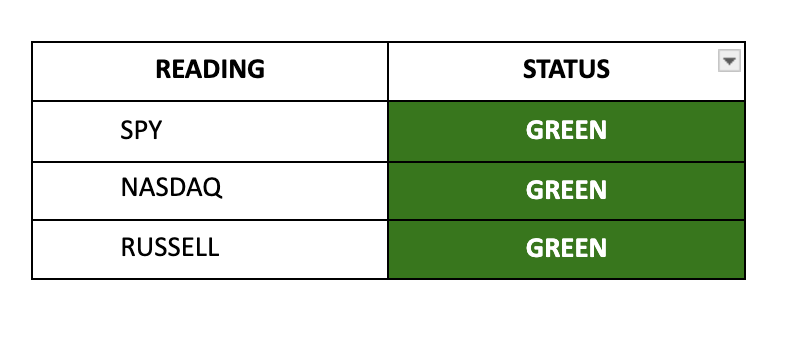

Equity Index Strength Is GREEN on the S&P 500 and GREEN on the Russell 2000

Each morning, we assess the full flows of the market by measuring statistical metrics on a very specific number of stocks to determine broader sentiment and the momentum trend. When these readings turn red, we focus on cash, build trades around positive sectors, or take inverse positions against indices. When it is positive, we focus on short-squeeze stocks, companies with improving fundamentals, and trading/investing around the actions of corporate insiders.

Momentum in this market is the strongest that we’ve seen since November 2021, and we now have about 50% of all S&P 500 stocks in overbought territory. The last time we saw that happen was in 1991.

There are still trillions of dollars locked up on the sideline, and the narrative is extremely bullish. That said… I have always urged some caution and recommend that we either take some profits or focus on selling put spreads on recent insider buys. We’re in a historical period, and it’s unclear how the Fed’s policies will work out in the months ahead.

Morning Notes:

Nippon Steel acquires U.S. Steel (X) for $55/share in a $14.1 billion deal. The acquisition offers a 40% premium over the recent closing price.

In October, 40% of federal student loan borrowers missed their payments as the pandemic-era freeze on debt expired. Fortunately for borrowers, the Education Department will not report these delinquencies until the end of September 2024.

Chinese agencies and state firms are increasingly barring staff from using Apple (AAPL) iPhones to reduce dependence on foreign technology.

Major shipping companies are rerouting from the Red Sea due to escalated attacks from Houthi militants. This move affects key East-West trade routes, especially oil transportation through the Suez Canal.

It’s damage control week, as the Fed will trot out several speakers this week to provide arguments that no one in this market will want to believe: That the Fed is set to cut rates sooner than later.

Keep reading with a 7-day free trial

Subscribe to Postcards from the Republic to keep reading this post and get 7 days of free access to the full post archives.