Postcards: Riding the Electric Centipede

How insane is the AI Bubble? More insane than you realize... and yet... we're still trading into the night to maintain our purchasing power as a corrupt, broken system reaches terminal velocity.

Dear Fellow Expat:

Like a Gonzo journalist speeding headfirst into the madness of Las Vegas…

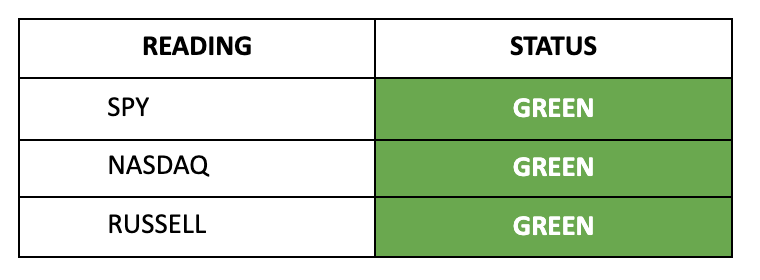

Here we are as investors and traders… revving up the engine… fully aware of the dangers that lurk ahead… but armed with a deep knowledge of global liquidity, momentum, and when it’s time to fold the cards with our Equity Strength Signals.

As investors, we’ve been bullish since November… when our equity signals turned positive. Add on a lot of capital sloshing around and an ongoing wave into U.S. markets, and you end up with the Global Markets being overweight on America.

To be candid, it was hard to anticipate this frenzy. Markets didn’t even blink at the last two weeks of February, historically the worst seasonality period.

Tech stocks continue to hold their ground.

With four stocks still driving the Nasdaq 100 (QQQ) rally and Bitcoin now above $65,000, we are facing the throws of the most absurd portion of the frenzy.

This is where performance detaches itself so much from the underlying market…

Keep reading with a 7-day free trial

Subscribe to Postcards from the Republic to keep reading this post and get 7 days of free access to the full post archives.