Postcards: How to Spot a Fraud

The intersection of baseball cards and Wall Street tells us to avoid this stock.

Dear Fellow Expat:

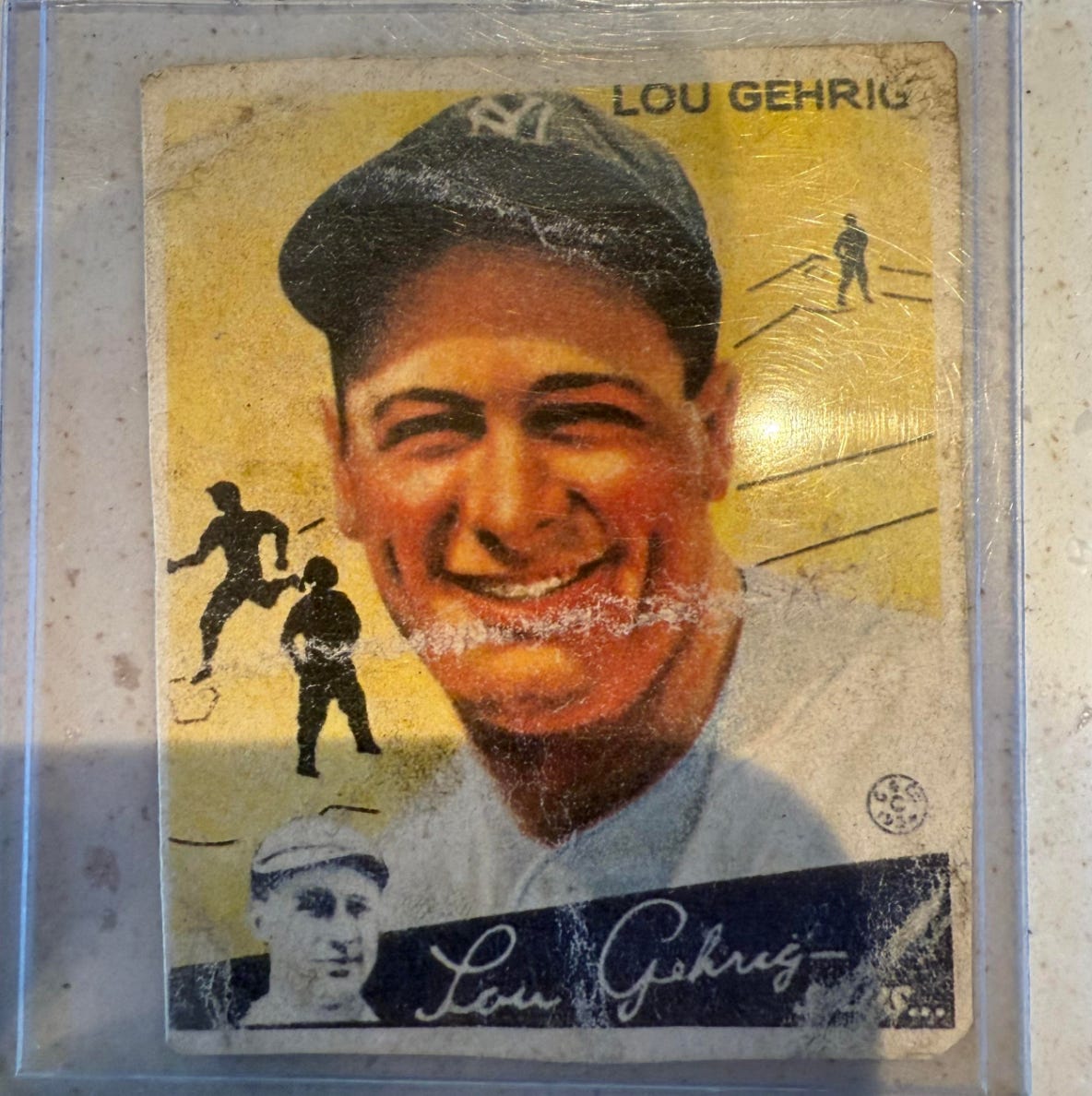

Look at these two baseball cards.

This is the 1934 Goudey Lou Gehrig #37.

If a company like PSA graded a ‘34 Gehrig Goudey in poor condition (the lowest possible), it’s still worth $2,100.

The next is the 1951 Bowman Mickey Mantle.

This is the first Mickey Mantle card - his true rookie card.

Keep reading with a 7-day free trial

Subscribe to Postcards from the Republic to keep reading this post and get 7 days of free access to the full post archives.