An Early Thanksgiving Dinner Pick

Bitcoin, Palantir, GEO Group, and Tesla were just the appetizers for big gains. Here's the main course, the desert, and the after dinner drinks.

Dear Fellow Expat:

I'm already planning my Thanksgiving dinner conversation with my father-in-law, Tim Melvin...

I can already hear his dogs barking and my wife sneezing from his cats.

For decades, Tim’s focused on value, quality, and niche parts of the markets few people explore. I’ve been on the other side of the bell curve in momentum, alternatives, and macro.

Those who watched us on Money Morning LIVE know he has many opinions, but he also has the facts on his side. And he recently launched a Substack letter, which you can find by clicking here.

Readers and viewers in the Republic have always been fascinated by these dinners. Every year, our conversation inevitably leads to a clear set of financial trends for the coming year.

Today, we planned our visit to Florida to see him. As we talked, he described one of the biggest winners of the Trump 2.0 agenda.

And it's not getting any attention right now in the media.

The Biggest Trump Trend Hiding in Plain Sight

Tim and I tried to launch an investment fund a few years ago.

COVID-19 disrupted our plans – but our strategy was simple...

We were focused on community banking.

Tim is the top community banking analyst in the country. And he knows better than anyone that community banks have generated incredible returns over the last three decades with a very low beta.

How?

Because they've been bought out at a 3% to 5% rate over the past 35 years.

In 1987, there were over 12,000 community banks across America. As of last year, that number had shrunk to about 4,700 FDIC-insured commercial banks and savings institutions.

Consolidation did that.

Now, community banks are typically smaller and run by people who live in that community. You know, the kind of place where the bank president might be sitting next to you at your kid's baseball game.

Think of them as the mom-and-pop shops of the banking world. They make their money the old way – by lending it to local businesses and families.

We're talking about banks worth anywhere from $50 million to $2 billion, which might sound huge, but that's modest in banking terms.

What makes these banks special? Well, it's all about relationships.

Your local community banker probably knows your name, your business, and maybe your dog's name. They're invested in your town, not just working in it. When the local hardware store needs a loan to expand, these people understand why that matters to the community.

These banks aren't out making wild bets on the market. They're conservative… and stick to what they know – like understanding exactly what that downtown building is worth as collateral or knowing which local businesses have solid track records. This careful approach helps keep them stable, which is exactly what you want in a bank.

But that trend of consolidation has continued.

In the next few years, it's likely to generate some of the highest uncorrelated financial returns—all with a deeply conservative approach.

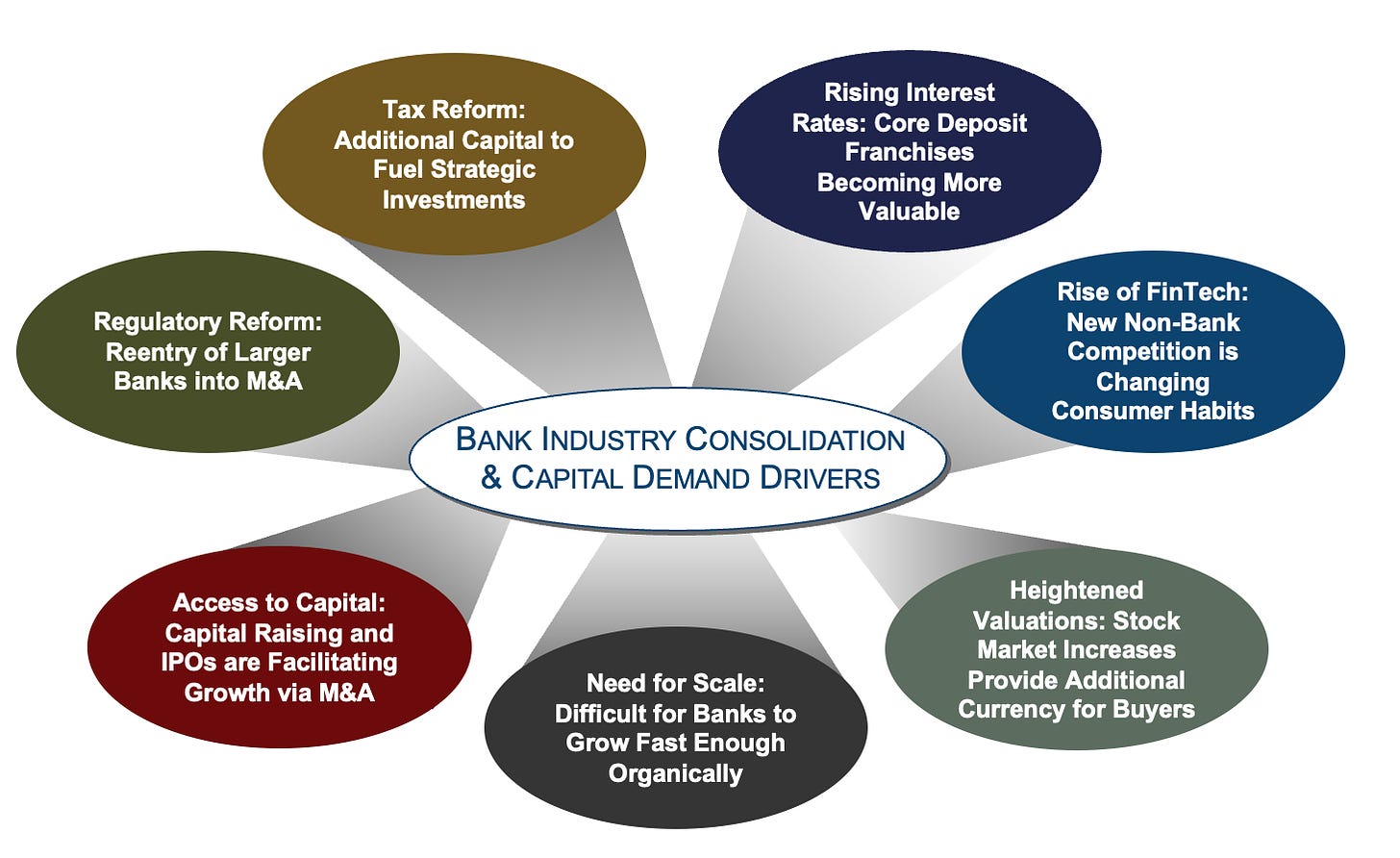

Why Banking M&A Is About to Explode

Tim has been recommending tiny banks for his entire career, but he's particularly excited about the next four years.

Deal-making in this space was very healthy during the 2016-2020 Trump years.

The industry saw significant takeovers thanks to changes in laws that benefited mergers. But then, under Biden's FTC – we saw a significant drop in the action. In fact, you might only be able to name high-profile deals that were effectively forced by the government during the regional banking dust-up in March 2023 (you know, the ones that made JPMorgan Chase (NYSE: JPM) even stronger).

"The last four years featured a Biden Administration hostile to any form of consolidation," Tim said. "There's so much pent-up demand for banking deals."

Now – let's step back for a second.

Why do banks need to merge in the first place?

The biggest issue for would-be buyers is deposits.

You know, the money people keep in their accounts.

Banks need these deposits to make loans and grow.

They can get more deposits in two ways: either wait for more people to move to town (which happened in places like Texas and Florida as folks fled high-tax states during the COVID years) or buy another bank that already has those deposits.

That's on the BUYER side.

The reality is that the seller side is even MORE motivated.

Running a community bank isn't what it used to be. Regulation costs have exploded over the last decade, making operating harder.

So, too, are technology costs (the biggest driver of selling, according to our mutual research).

Creating mobile banking apps and keeping up with the latest cybersecurity features is expensive. The trends outlined in 2019/2020 during Trump 1.0 are the same today.

But there's another trend that Tim hammered today that resonated.

A few years ago, many bank owners were in their late 60s and early 70s. Now, they're in their late 70s with no real succession plan.

There's a massive talent issue: It's hard to find young people who want to work at small-town banks when the bright lights of Wall Street are calling. Even the owners' children – if they too are bankers – likely joined Lazard (LAZ) or JPMorgan Chase (JPM) in Manhattan instead of staying in their hometown.

An Active Place for Value Investors

In banking, sometimes smaller is better...

These banks are the backbone of local communities. And they're also some of the most sought-after assets in all equity markets today.

We'll continue to see smaller banks merge with bigger ones, especially after tough economic times. And for investors who know what to look for, there are some incredible opportunities.

Tomorrow, I'll focus on regional banking... and one specific bank that stands out for different reasons than we've discussed today.

Stay positive,

Garrett Baldwin

Secretary of Finance